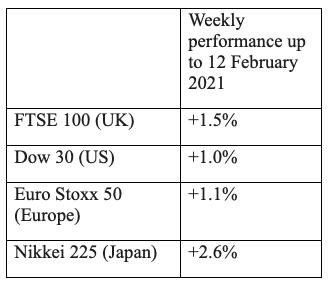

In what felt like a relatively quiet week with lower daily market movements than we have been experiencing recently, all of the major equity markets enjoyed steady growth last week. The FTSE 100 index was boosted by a positive showing on Friday as the UK’s coronavirus R rate fell below 1 and better than expected economic data. The UK economy dodged a double dip recession as the economy grew by 1% in the final quarter of 2020 which was a pleasant surprise as economists were predicting 0.5% growth.

In the United States, all three major equity markets (Dow Jones 30, S&P 500 and Nasdaq) all set record closing highs.

In terms of £ Sterling, it closed the week (to 12 February), at 1.38 US Dollars, which was 0.8% higher than the figure at the end of the previous week (5 February).

Against the Euro, £ Sterling closed on 12 February at 1.14 Euros, which was up 0.2% on the closing figure on 5 February.

Inflation, as measured by the Consumer Prices Index including owner occupiers’ housing costs (CPIH) was 0.8% in December 2020 (this is December’s data which is reported in January). This was up from 0.6% in the previous month, largely as a result of rising transport costs and increasing prices for clothing and recreation and culture. The 12-month rate for the Consumer Prices Index (CPI) rate which excludes owner occupied housing costs and council tax was 0.6% in December, up from 0.3% in November.

There were no further changes to the Bank of England base rate last week following the two previous cuts in March. The current rate remains at 0.1%.

The Omnis Managed funds, Openwork Graphene Model Portfolios and Omnis Managed Portfolio Service provide you with a diversified asset allocation in line with your Attitude to Risk, investing in Developed Market Equities, such as UK, US, Europe and Asia Pacific as well as Emerging Market equities. Cautious and Balanced investors will also have significant holdings in UK and Global Bonds, as well as Alternative Strategies.

We believe this multi-asset approach aims to minimise global equity market falls in volatile periods.

If you would like to speak with us, then please make contact.

Best regards

Andrew & Richard

Andrew S. Turner MSc Cert CII FPFS Certs (MP & ER) and Richard Olive BA (Hons) APFS

Karrek Chartered Financial Planners

Office: 01637 853153