The 2023 Autumn Statement: Winners and Losers

UK Chancellor Jeremy Hunt’s 2023 Autumn Statement outlined, in his words, “eight months of hard work” and no fewer than 110 measures to help grow the British economy. Contained within are a raft of measures set to overhaul everything from minimum wage and benefit payments to tax, business investment, and more.

On a mission to find the right remortgage deal?

We can be your expert guide.

We can comb through thousands of mortgage products and access deals that you won’t find on the high street, so you can be sure you’ve got the right mortgage for you. Get in touch with an expert adviser today.

—

YOUR HOME MAY BE REPOSSESSED […]

Omnis’ thoughts on the Credit Suisse situation

The announcement that Saudi Bank (who own around 10% of Credit Suisse) would not invest in more equity in Credit Suisse triggered the recent share price collapse (and large widening in credit spreads). In reality, regulation prohibits Saudi Bank to own more than 10% in any case. The Swiss National Bank has stepped in to provide Credit Suisse with additional […]

An update on current geopolitical tensions

The Situation in Eastern Europe has escalated with news that Russia has launched an invasion of Ukraine.

The current situation

A wholesale Russian invasion of Ukraine takes us back to a world we thought we had left behind decades ago. From a social and political perspective, the impact will be huge. As governments around the world contemplate their response, the potential for […]

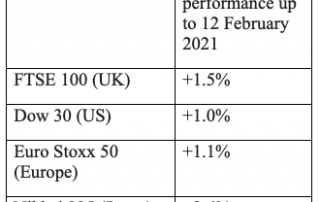

Week ending 12 February 2021 market update

In what felt like a relatively quiet week with lower daily market movements than we have been experiencing recently, all of the major equity markets enjoyed steady growth last week. The FTSE 100 index was boosted by a positive showing on Friday as the UK’s coronavirus R rate fell below 1 and better than expected economic data. The […]

Market Update – W/E January 22nd 2021 – A Mixed Week

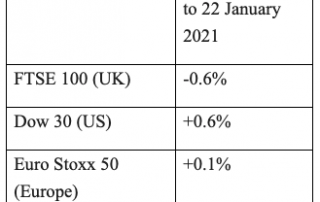

Week ending 22 January 2021 market update

It was a mixed week for global equity markets last week. In the UK, the FTSE 100 was down 0.6% as a combination of poor economic data and concerns of a longer-than-expected lockdown and harsher travel restrictions had an effect. However, in the United States, the Dow Jones 30 registered its […]

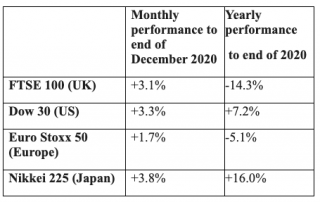

Market Update – December 2020 – A Positive Month

December was a positive month for global equity markets to close an extraordinary year. The coronavirus pandemic has caused significant volatility in global equity markets and while they have all recovered from their lows, the performance over the year is mixed.

The FTSE 100 index ended the year down more than 14%. The value and cyclical nature of […]

Investment Update: 5 Reasons to be positive on UK Equities

Please find Investment update from Colin Gellatly, Deputy Chief Investment Officer at Omnis Investments Limited.

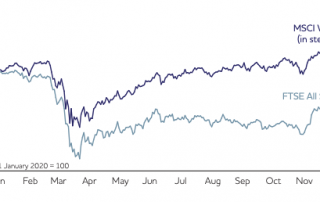

The UK stock market has been unloved and undervalued by investors for some time now. Yet we believe it’s already reached a turning point and is an attractive environment for active fund managers

If you would like to speak with us, then please make […]

Investment Update: November 2020 – A more certain outlook

Please find Investment update from Robert Jeffree, Chief Investment Officer at Omnis Investments Limited. If you would like to speak with us, then please make contact.

Best regards

Andrew & Richard

An update on mortgage payment holidays – ending soon.

In March this year, it was agreed with the Government that banks, building societies and other mortgage lenders should offer all existing mortgage customers the option of a three month mortgage payment holiday. This was subsequently extended to six months. If your finances have been affected by Coronavirus and you would like to request a mortgage holiday from your lender, […]

Investment Update – Sep 2020 – Brexit and the outlook for UK investors

Please download and read this Investment update from Colin Gellatly, the Deputy Chief Investment Officer at Omnis Investments Limited.

If you would like to speak with us, then please make contact.

Best regards

Andrew & Richard

—

Andrew S. Turner MSc Cert CII FPFS Certs (MP & ER) and Richard Olive BA […]

Could A Second Wave Indirectly Spur The Markets?

As we approach the latter stages of the third quarter, global markets continue to exhibit high levels of volatility in reaction to the Covid 19 pandemic.

With a resurgence of the virus widely expected, Governments and Central Banks are again poised to act with stimulus packages and further cuts to interest rates in a bid to provide more support to regional […]