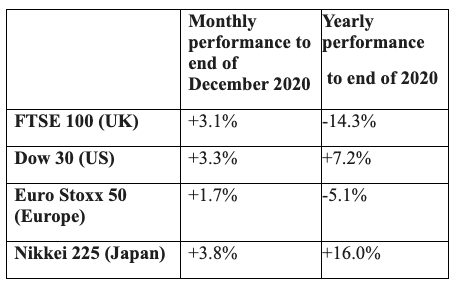

December was a positive month for global equity markets to close an extraordinary year. The coronavirus pandemic has caused significant volatility in global equity markets and while they have all recovered from their lows, the performance over the year is mixed.

The FTSE 100 index ended the year down more than 14%. The value and cyclical nature of the UK markets has caused a significant underperformance compared with their US counterparts.

Both the Dow Jones 30 and S&P 500 closed at record highs on the final day of 2020 to wrap up a year of surprisingly strong gains. The Dow Jones 30 ended last year up 7% and the S&P 500 closed the year 16% higher. At one point in 2020, the two market benchmarks were down more than 30% as the coronavirus pandemic ravaged the global economy.

The real standout of 2020 was the Nasdaq which gained over 43% for its biggest one-year gain since 2009. The Nasdaq’s outperformance came as investors and traders flocked into tech stocks in the throes of the Covid-19 outbreak.

Unprecedented fiscal and monetary support for the economy, coupled with the development and rollout of multiple Covid-19 vaccines, helped the market recover from its massive drop to trade back at all-time highs.

In terms of currency, £ Sterling ended December at 1.37 US Dollars. This was 2.6% higher than the figure at the end of November and up 3.1% on the year.

Against the Euro, £ Sterling ended December at 1.12 Euros, which was 0.3% higher than the November closing figure. Despite this, it was 5.4% lower than the figure at the end of 2019.

Inflation, as measured by the Consumer Prices Index including owner occupiers’ housing costs (CPIH) was 0.6% in November 2020 (this is November’s data which is reported in December). This was down from 0.9% in the previous month with falling prices for clothing, and food and non-alcoholic beverages resulted in the largest downward contributions. The 12-month rate for the Consumer Prices Index (CPI) rate which excludes owner occupied housing costs and council tax was 0.3% in November, down from 0.7% in October.

There were no further changes to the Bank of England base rate last week following the two previous cuts in March. The current rate remains at 0.1%.

The Omnis Managed funds, Openwork Graphene Model Portfolios and Omnis Managed Portfolio Service provide you with a diversified asset allocation in line with your Attitude to Risk, investing in Developed Market Equities, such as UK, US, Europe and Asia Pacific as well as Emerging Market equities. Cautious and Balanced investors will also have significant holdings in UK and Global Bonds, as well as Alternative Strategies.

We believe this multi-asset approach aims to minimise global equity market falls in volatile periods.

If you would like to speak with us, then please make contact.

Best regards

Andrew & Richard

—

Andrew S. Turner MSc Cert CII FPFS Certs (MP & ER) and Richard Olive BA (Hons) APFS

Karrek Chartered Financial Planners

Office: 01637 853153

—

Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested.