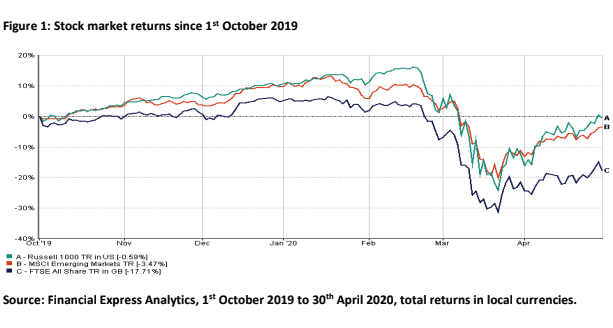

A fortnight ago we noted that, in spite of continuing lockdown measures and a raft of dire economic data, global stock markets had made a welcome – if partial – recovery from their late-March lows. Happily, this recovery has since continued almost uninterrupted. Having suffered a fall of historic scale and speed, the US stock market (as measured by the Russell 1000 index) ended April down ‘only’ 10% for the year to date. Remarkably, had you invested in the US stock market at the start of October 2019, the value of that investment would be almost unchanged (see Figure 1).

Figure 1: Stock market returns since 1st October 2019

Source: Financial Express Analytics, 1st October 2019 to 30th April 2020, total returns in local currencies.

As the chart makes clear, the UK stock market has been a laggard throughout this period. This serves as a reminder that, while Covid-19 is at the forefront of all our minds, it is not the only thing we need to keep an eye on. Firstly, though negotiations have been understandably delayed as politicians focus on the matter at hand, Boris Johnson’s government has thus far refused to countenance a delay to the UK’s withdrawal from the EU. This increases the risk of a hard Brexit at the end of the year – an outcome investors have long viewed as negative for UK assets. Secondly, the UK stock market has a relatively large exposure to the energy sector which has struggled as oil prices have fallen to multi-year lows.

While the UK demonstrates that attention must be paid to the particular circumstances affecting each financial market, it remains the case that – in the near-term, at least – asset prices everywhere will be heavily influenced by how the coronavirus crisis develops. Two weeks ago, we set out four issues we believe are key to determining the outlook in this respect. The news flow on these issues has since been almost universally positive.

Firstly, we noted that the crisis will only truly end with the development of an effective vaccine. While there has been no miracle breakthrough on a vaccine, initial tests suggest that Remdesivir, a drug originally developed by US pharmaceutical company Gilead to treat Ebola, may aid the recovery of those who have contracted coronavirus. First and foremost, an effective cure would reduce the human cost of the pandemic. It would also alleviate the strain on healthcare services and reduce the threat posed by a possible ‘second wave’ of infections following a relaxation of lockdown measures.

Secondly, though economic data make for bleak reading, there are signs that the global economy is still in some sort of working order. On the one hand, it was confirmed this week that the US, French and Italian economies all contracted by 5% to 6% in the first quarter of 2020. However, the declining pace at which jobs are being lost in the US suggests state aid is starting to reach the places it is needed. Meanwhile, central bank support has enabled bond markets to function, allowing many companies to raise additional capital to help see them through the crisis. In effect, the global economy has been parked in the garage. While some rust will inevitably accumulate, thanks to the attention of fiscal and monetary policymakers it looks likely that the engine will fire once the keys are returned to the ignition.

Third, we noted the likelihood of keeping the global economy in working order is closely tied to the duration over which the lockdown measures are required. Cautious relaxation of restrictions across much of Europe, Australia and New Zealand is therefore welcome. It is possible the UK may again be something of an outlier in this respect. The government’s aim to “flatten the curve” means new infections should peak at relatively low levels, but it also means infection rates in the UK are unlikely to decline as rapidly as they have in countries where stricter lockdown regimes were imposed. It is possible that lockdown in the UK will need to endure longer than it has elsewhere.

Finally, we are paying close attention to how markets absorb the huge amounts of debt that have been created by the policy response. As central banks around the world have stepped in to buy enormous quantities of their government’s debt – and, in places including the US and Europe, debt issued by the private sector too – this is a question the market has not yet had to deal with.

China and South Korea have shown that there is a path out of this but the experience for each country will differ in timing. The recovery in global stock markets reflects improvements in the outlook, and to that extent are justified. However, while the path remains navigable, it is unlikely to be smooth sailing. This is true both in economic terms, and from an investment perspective.

From an economic point of view, the virus’ impact is likely to remain visible for some time. For example, while we estimate around 90% of China’s manufacturing activity has resumed, Chinese retail stores are reporting foot traffic at just 60% of normal levels, with per customer spending lower than pre-crisis levels. While we expect the global economy to recover in the second half of the year, we are cognisant that governments, businesses and individuals will take some time to adjust to post-lockdown conditions. This period of adjustment is likely to moderate the pace of the recovery.

With little precedence in modern history, the recovery is also likely to be somewhat tentative. New policies and behaviours will need to be tested and assessed: not all will be successful. A stop-start economic recovery may well lead to heightened volatility in financial markets. Collectively, investors have a tendency to place too much emphasis on recent events. Thus, a series of positive developments can give rise to excesses of greed, while a period of negative news flow can give rise to despondency. As policymakers strive to keep the global economy upright, any wobbles may well be amplified in financial markets.

As noted above, recent weeks have been characterised by positive developments in the global effort to contain the coronavirus. Stock markets have responded enthusiastically to these developments. This raises the question of whether investors have allowed themselves to get carried away. We do not believe this to be the case. Policy support for the world’s economy and its financial markets is significant and likely to be long-lasting. Meanwhile, valuations based on longer-term measures of company profits – for the most part – appear reasonable.

In conclusion, though investors should not expect stock markets to continue rising without interruption, we believe the global economy will recover and that this should be to the benefit of long-term investors.

Colin Gellatly Deputy Chief Investment Officer, Omnis Investments

Omnis Investment Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your Openwork financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given.

The value of an investment and any income derived from it can fall as well as rise and you may not get back the original amount invested. Past performance is not a guide to future performance. The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Washington House, Lydiard Fields, Swindon, SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.